Harley Davidson India Finance

Not all applicants will qualify.

Harley davidson india finance. Harley-Davidson can significantly improve its chances of success in India by undergoing a strategy overhaul. Harley-Davidson reimburses dealers for performing manufacturer-specified pre. Proficient in budgeting planning and auditAccounts receivable Accounts payableTDS GST returns Auditing Fixed assets Compliance.

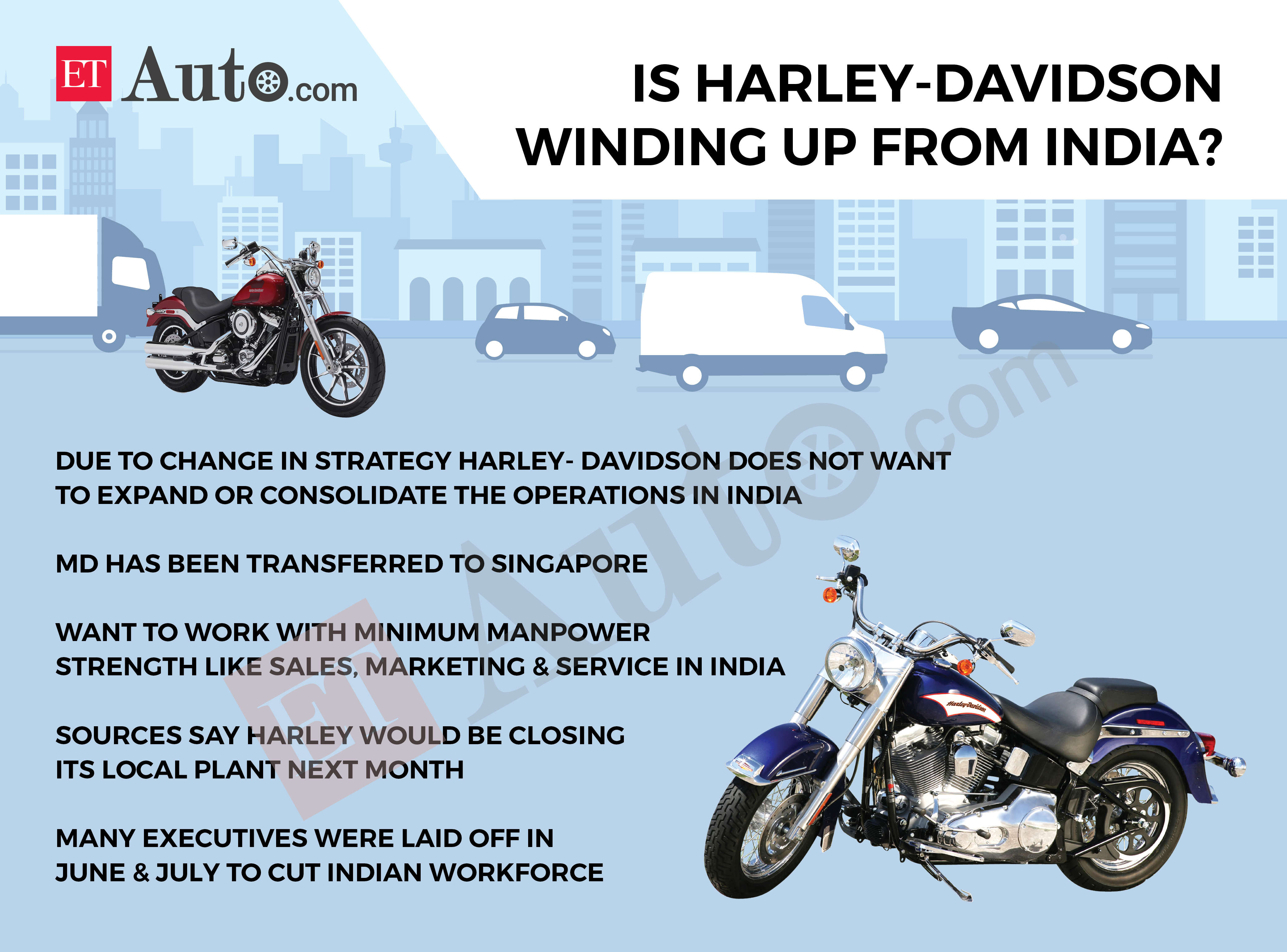

Harley-Davidson plans to shut down its assembly unit in Bawal Haryana state and lay off 70 employees. Yes the indian market is really suitable to lauch the products of the brandBut HD will have to face. MBA Finance with 9 years of experience in finance and accounts in the Automotive industry Cars Bike.

Harley-Davidson is ending operations in India as part of Rewire strategy. The Hardwire is Harley-Davidsons 2021-2025 strategic plan guided by our mission and vision. Since fiscal year 2017 there was a continuous decline in.

The company reported a 96 million loss between April 2020 to June 2020 which is the first quarterly loss for the motorcycle maker. Technology skills brand and reputation. The APR may vary based on the applicants past credit performance and the term of.

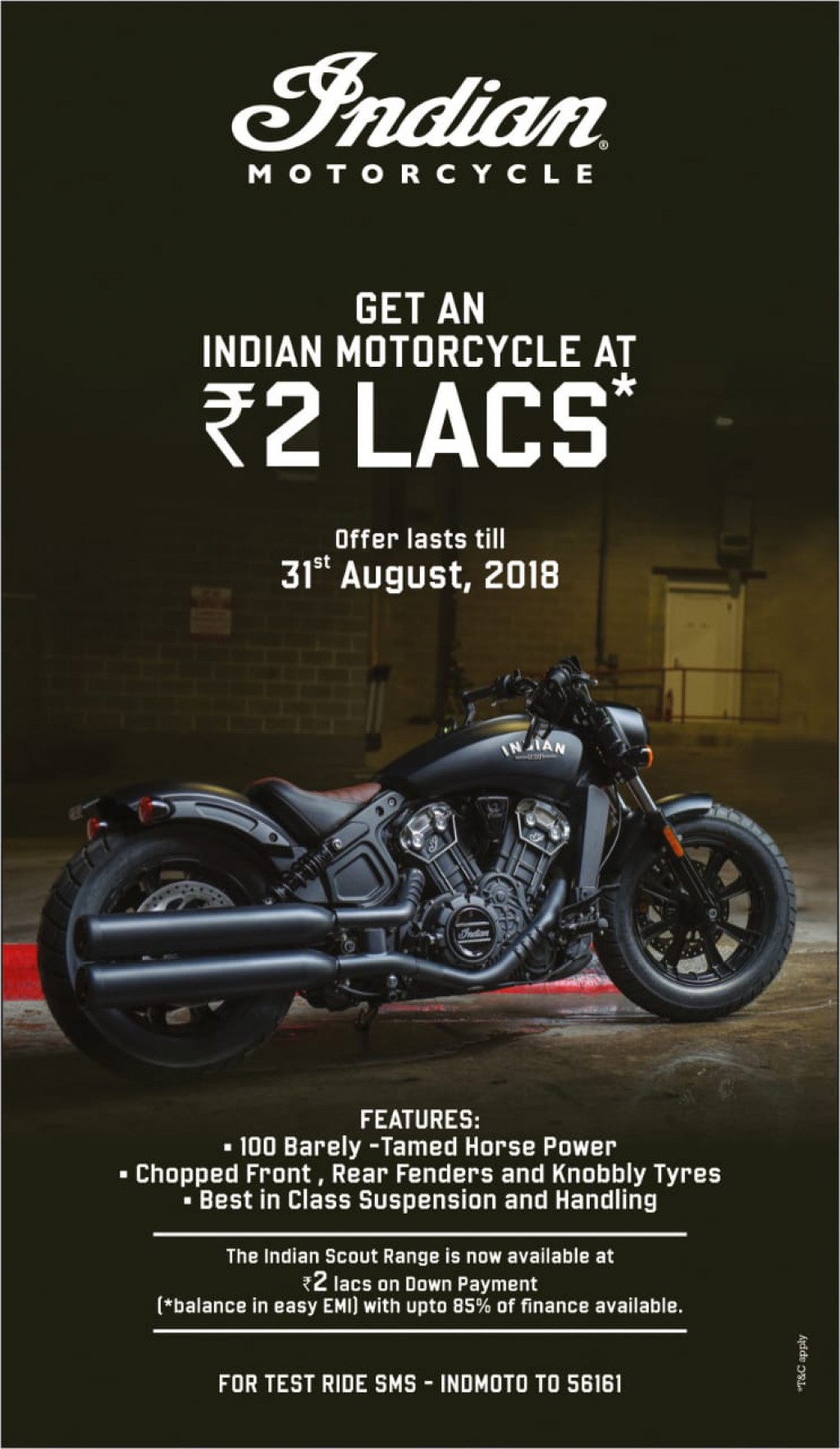

Harley-Davidson to shut sales and manufacturing operations in India Business News. Engages in the production and sale of heavyweight motorcycles. The function of Harley-Davidson Financial services is dealing with the dealers and providing finance to them and to spread in the regions like US Canada and EuropeThe line of the US motorcycle consisted of five different basic models coming in several versions and having price between 8000 and 37000.

299 APR offer is available on new HarleyDavidson motorcycles to high credit tier customers at ESB and only for up to a 60 month term. The next step in our Internal analysis of Harley-Davidson Inc. It operates in two segments Motorcycles and Related Products and Financial Services.